The usual narrative about the “Volcker shock” leaves a lot out — and policymakers risk learning the wrong lessons.

As inflation persists at multi-decade highs, the pressure is on the Federal Reserve, above all other economic policymaking institutions, to halt rising prices. The central bank is expected to raise rates again Wednesday for the sixth time since March.

Since the climax of the last major inflation crisis in the 1970s, independent central bank chiefs willing to administer proverbial harsh medicine — raising interest rates so high they potentially cause a recession — have reigned like near-deities over our economic lives.

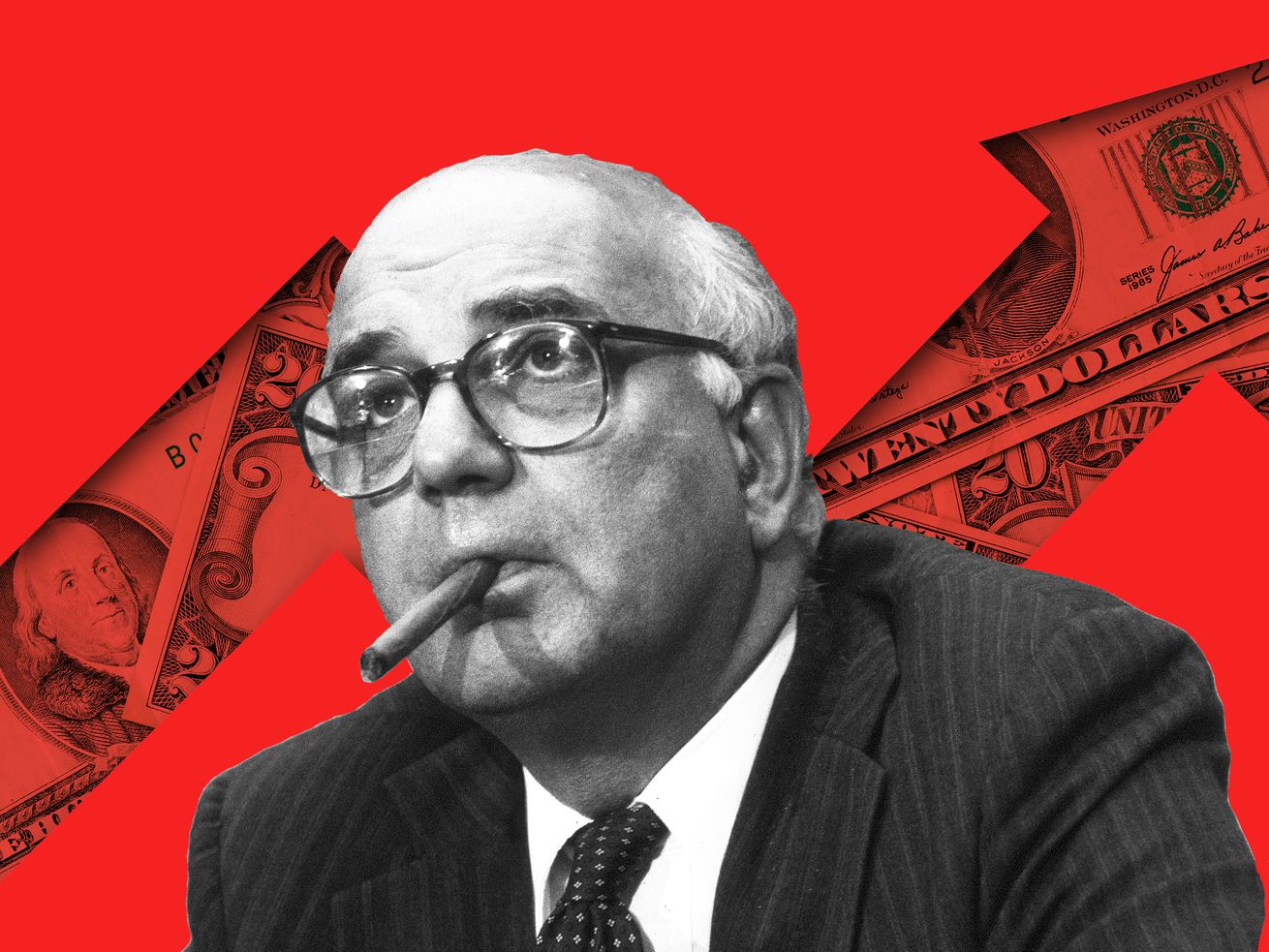

In this, Fed Chair Jerome Powell stands in the shadow of his most legendary predecessor, the late Paul Volcker. Inflation hawks want Powell to go “full Volcker”: follow the elder banker’s example from 1979 and raise interest rates high enough to choke off demand, even at the cost of a devastating recession.

The Volcker shock looms large in the mythology of central banking: the moment when neoliberal Zeus slew the old economic Titans standing in the way of progress. Volcker’s rate hikes sent the US economy into the worst recession since the Great Depression during the early 1980s, but it eventually recovered into what’s called the “Great Moderation”: a more than three-decade stretch when inflation seemed banished even as economic growth returned.

Powell’s Fed has raised interest rates throughout 2022, and looks like it wants to channel Volcker, at least in spirit. But this “great man” story of inflation-fighting that gives the credit for stable prices to technocratic central bankers fiddling with interest rates leaves out a good deal of context that explains not only why inflation cratered, but why it stayed down.

Central bankers can engineer a sudden shortage of credit, but they can’t necessarily address knottier distributional questions, like whether workers should have the legal means to demand higher wages. Nor can they build the systems and infrastructure that increase productivity and access to cheap stuff, which are the product of decades of investment and coordination.

In other words: The monetary tightening inaugurated by Volcker was one part of an entire deflationary policy repertoire that also included union-busting and the creation of a global supply chain to hold down the costs of labor, components, and commodities.

Neither of those options outside the realm of monetary policy is really available right now. While wages have risen, unions aren’t the real force pushing up pay anymore. And the global supply chain that gave us cheap imports from anywhere in the world is part of the problem: It’s currently breaking down. The Fed might be able to choke off credit to slow investment and job creation, but it can’t create the real-world political, legal, and logistical systems that in the past have kept prices down even amid economic growth.

To truly tame prices, we can’t just turn off the money hose. We have to plan for more concrete long-term solutions to a lack of labor, commodities, and goods.

How union-busting helped defeat inflation

The Fed has one main knob to turn to raise or lower the economy’s temperature: interest rates. When the Fed raises the cost of borrowing money from the central bank, the rest of the financial system that ultimately provides credit to businesses and households raises its rates in turn, reducing the amount of money available to open new businesses, finance big new projects, or buy homes. This is supposed to lead to fewer jobs, slimmer household budgets, and less confident workers making fewer demands of their bosses, slowing down spending and wage growth.

The relationship between inflation and employment is described in the famous 1958 economic theory known as the Phillips curve, which states that inflation rises as unemployment falls.

The conundrum described by the Phillips curve — that more jobs mean higher prices — was at the heart of conversations about pre-Volcker inflation: It appeared that after the unprecedented boom of the 1950s and 1960s, when large numbers of American employees first achieved middle-class standards of living, we consumed more than could be efficiently produced and, for instance, became more reliant on imported oil.

As prices for gas to fill boat-sized cars soared, workers asked for raises, compelling their bosses to raise prices to pay those high wages, which put pressure on their customers to demand raises from their bosses in turn — what’s known as a wage-price spiral. All the while, supposedly feckless central bankers avoided sharp interest rate hikes that might have cut off demand, trying to please politicians riding high on the birth of mass affluence. No one had the nerve to stop the cycle.

In the heroic model of central banking, Volcker and his successors like Alan Greenspan stopped the vicious wage-price cycle not only by raising rates, but by establishing the central bank’s “credibility” that the institution was independent from elected officials. That is, investors, employers, and workers could now credibly expect the central bank to raise interest rates if the economy got too hot, and would temper their wage and price setting accordingly. When expectations about future inflation are grounded by the sense that the Fed will intervene before prices spiral out of control, economic actors are supposed to have confidence that their assets will retain value, so they’ll feel safe investing or hiring.

Confidence in central bank independence allowed for the “Great Moderation” of the late 1980s through the 2000s, where growth continued — albeit much more slowly than during the post-WWII years — and unemployment fell without sparking inflation.

It’s a very elegant schematic of balanced forces and rational actors. But it leaves out the messier side of the deflationary story of the late 20th century.

The wage-price spiral might have been broken in the 1980s by less savory means. As senior Fed economists David Ratner and Jae Sim wrote in a paper earlier this year, the wage-taming owed a lot to nitty-gritty union busting and labor policy that makes it harder to organize and collectively bargain.

In other words, they write, inflation may arise not from “too much money chasing too few goods,” as mainstream economists typically argue, but as a side effect of class conflict. Without strong unions, workers are less able to demand higher wages even as labor demand grows, flattening the Phillips curve. Ratner and Sim’s analysis found that loss of worker bargaining power reduced inflation volatility by 87 percent even without monetary interventions like interest rate hikes.

Volcker’s shock and central bank independence happened at the same time as Ronald Reagan’s anti-union effort; the emergence of New Democrats like Jimmy Carter and Bill Clinton, who were less sympathetic to organized labor than their New Deal and Great Society forebears; and the collapse of union membership across almost every sector of the economy except government. Volcker and his central banker colleagues were keenly aware of the importance of union power to increasing wages: The minutes of Fed meetings show that these policymakers fixated on the ability of unions to set wages even after many academic economists had moved on from the subject.

Unions may be notching some wins right now, but the national unionization rate is half what it was in 1983, when the Bureau of Labor Statistics started tracking the metric. Today, rather than pushing for higher wages, unions may in fact be suppressing them: By negotiating long-term contracts, they lock in pay for their members for years at a time, regardless of what happens to price levels. Pay increases are instead driven by a wave of retirements that were likely inevitable at some point in the near future, new labor market opportunities created by remote work, and a massive number of quits in difficult, typically lo- paying jobs in health care, retail, and food service. And for all the labor market chaos, wages haven’t driven inflation, instead lagging behind the cost of living. So it doesn’t appear the calls for Powell to go full Volcker would actually solve current causes of rising prices. If we want growth without inflation, we have to find new sources of labor, energy, and stuff.

The supply chain frontier has closed

Just as Volcker’s rate hikes coincided with a bipartisan anti-union push, so the rise of central banks paralleled the acceleration of globalization and the creation of a world-spanning super-efficient “just in time” supply chain. New logistics infrastructure, trade deals, and methods of inventory management allowed firms to get cheap commodities and components from the other side of the world astonishingly quickly. Globalization also reinforced the attack on unions, since it allowed businesses to move factories to countries with weaker labor laws, humbling labor leaders of industrialized economies. After the 1980s, and especially after the fall of the Soviet Union, markets began to integrate many formerly communist countries with large, well-educated — but poorly paid — workforces and ample natural resources. The creation of global supply chains depended in large part on a relatively calm geopolitical scene, with no serious confrontations between “great powers,” who generally seemed to be on the same page regarding globalization.

The globalized world of fast free trade was supposed to take the sting out of the demise of labor’s bargaining power. Sure, workers couldn’t improve their working conditions or pay. But if the stuff their wages bought got cheaper, economists reasoned, they would have less need to demand higher pay in the first place. As some post-Keynesian economists have argued, inflation moderated when globalization increased imports and labor competition, not because investors had “anchored expectations” about central bank policy.

It’s this model of globalization that is currently breaking down, leading to volatile rising prices. As anyone who has ordered a piece of furniture in the last two years can tell you, “just in time” has become a thing of the past. Instead of speedy manufacturing getting imported from any nation on earth, now we import their supply chain bottlenecks, as, say, plumbing component manufacturers in China hamstrung by that country’s “zero-Covid” policy hold up house completions in the United States.

While supply chain bottlenecks were widely predicted to ease in 2022, geopolitics got in the way. The Russian invasion of Ukraine and subsequent economic retaliation rocked global energy supplies, a particularly troubling economic disruption since energy is a vital component of nearly every product, and further poisoned relations between wealthy Western countries and Russia’s key ally, China, where so much of the stuff Americans buy is made. Instead of getting more cheap electronics from China, the world’s second-largest economy, the US is sanctioning the chip industry there.

If the Federal Reserve is largely removed from the internal dynamics of the labor market, it has even less to do with foreign policy and geo-strategic maneuvering.

Policymakers risk fighting the last war

The Federal Reserve is several months into its most aggressive rate-hiking cycle since Volcker’s famous shock, and inflation has not subsided. Even as higher rates choked off home sales and slowed job growth, September saw annualized inflation of 8.2 percent. The Fed’s higher rates seem to be imposing the expected economic pain, but with little deflationary pay-off.

Instead, what little relief Americans have enjoyed has come from unconventional direct interventions in the real economy, like the Biden administration’s release of oil from America’s Strategic Petroleum Reserve during the spring and summer. A July Treasury analysis suggested the SPR release, with similar international actions, lowered gas prices by 17 to 24 cents per gallon.

It seems that the lessons of the Volcker era do not necessarily apply to 2022. Though our own era is dominated by rising prices and highly politicized conflicts over energy, just like the 1970s, the particulars of our current inflationary dynamics appear quite different. So it’s natural to wonder if the same policy tools will necessarily work to slow rising prices.

We don’t want policymakers to make the mistake of fighting the last war. If we leave inflation up to the central bankers rather than continuing the push for coordinated investments in cost-saving renewable energy and dense housing, or policies that reverse the shrinkage of the labor supply since the pandemic, we won’t so much beat inflation as resign ourselves to a poorer, less-resilient future.

0 Comments