Inside the under-the-radar business that makes more money than Amazon Prime.

Type any random product into Amazon’s search bar and look closely at the results. If you don’t scroll, every listing in front of you will most likely be an ad, signaled by a small label with the word “Sponsored.”

And it’s just the beginning.

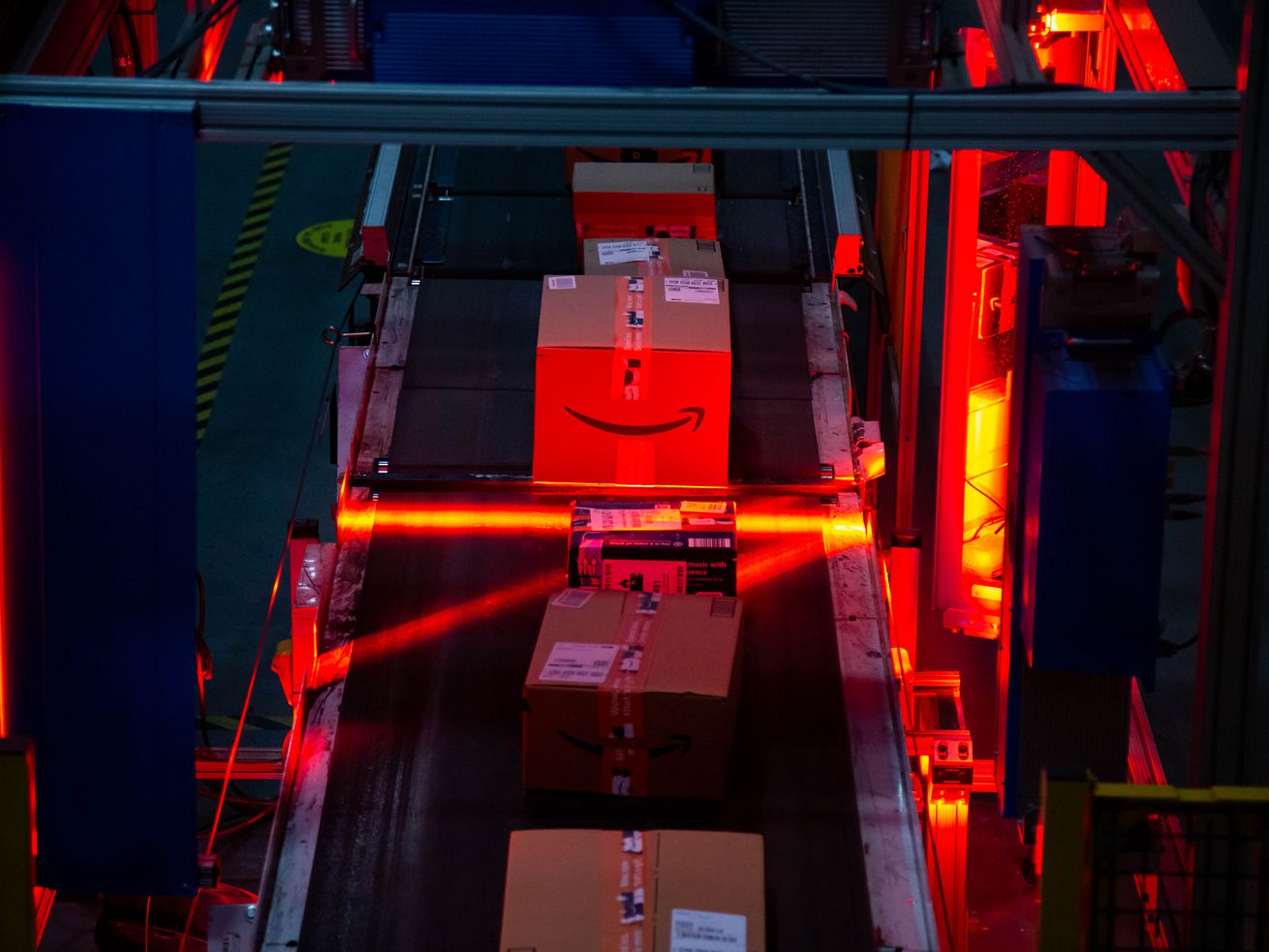

While company founder Jeff Bezos once said that “advertising is the price you pay for having an unremarkable product or service,” Amazon has in recent years become an ad-selling machine, driven by the substantial profit margins and the rising value of digital retail estate on the most popular shopping site in the West. As a result, Amazon’s ad business grew 58 percent in 2021 to more than $31 billion in revenue, making it the third-biggest online ad seller in the US, only trailing Google and Facebook. In the first nine months of 2022, Amazon’s ad revenue surpassed the money the company makes from Prime, Prime Video, and its other audio and e-book subscriptions combined. Along with Amazon Web Services, advertising has emerged as one of the company’s top two profit engines.

Advertising is now a crucial part of Amazon, and the company has ambitious plans for the future — highlighted by a flashy New York City event for advertisers in October, capped off by a private concert by the Killers, that industry executives said was a reflection of the company’s growing ambition in the sector. Amazon has designs to boost its ad business to new heights by selling more video commercials on Amazon properties like the video game livestreaming service Twitch and during live sporting events streamed on Prime Video; and by offering audio ads on Amazon Music. The company has also invested heavily in in-house software tools that allow brands to purchase highly targeted ads around the web.

With this transformation, Amazon has become a power player in yet another industry, adding advertising to a list that already includes e-commerce, logistics, entertainment, cloud computing, and voice assistants. But as in the other sectors it’s upended, Amazon’s rise in advertising will unleash complex ripple effects on millions of people, from small business merchants trying to make a living from selling on Amazon, to people whose experiences buying stuff online will continue to be altered — on Amazon and its competitors, from Walmart to Home Depot, who are following Amazon’s lead and adding more ads. Some of those changes may be good for those impacted; others might not be so lucky.

“Amazon is always inventing to ensure that our advertising products help customers discover selection they love and help sellers cost-effectively succeed in our store,” Amazon spokesperson Patrick Graham said in a statement. “Customers have many choices for where to shop, and businesses have many choices for where to sell, and we are excited by the positive response from both customers and advertisers to the value our optional advertising services provide them.”

A short history of ads on Amazon

“Everything’s an ad,” said Adam Epstein, co-president of Perpetua, an advertising technology firm that purchases more than $1 billion of advertising through Amazon annually.

That’s what the Amazon shopping experience feels like today, even if ad executives like Epstein believe that some Amazon ad types, like sponsored product videos, improve the experience for the rest of us. This evolution has been years in the making. While Amazon hired its first big external advertising executive back in 2008, the company’s advertising business only became substantial over the last decade. A big reason for that was the introduction of “sponsored product” ads, which let advertisers bid on commonly searched keywords to promote their products at the top of search results on Amazon. Today, they are absolutely everywhere on Amazon’s website and app.

Many advertisers love them — and they have good reason to. While Amazon’s search results ads are a similar approach to Google’s — where advertisers bid on certain keyword search terms to show their product listings at the top of search results — there is one crucial difference: Someone searching for a product on Amazon is usually in the market to buy it soon, while someone searching on Google may just be researching it.

Another difference is that after clicking on an ad on Amazon, the customer often makes a purchase within Amazon’s site, giving the company a better, though not perfect, view of which ads may have resulted in a purchase and which didn’t. Google search ads usually drive users to another site, which makes measuring ad results a bit more complicated, and some Google users may go on to make a purchase at a physical store, further clouding measurement of whether the ad worked. This so-called “attribution” on Amazon can give advertisers a better view and more confidence into which of their ads are actually working — i.e. resulting in a sale — and which aren’t. And, as we’ll get to, Apple has recently made it harder for advertisers to target customers as they move between various apps, which has made the Amazon closed ecosystem more attractive.

But the growth of ads on Amazon has sometimes caused internal tensions at the company. In the early days, some Amazon leaders were annoyed that Amazon vendors were being persuaded to spend money on advertising rather than on under-the-radar product placements that were even more profitable for Amazon, and which didn’t require the company to hand over any real data to brands to show what was working and what wasn’t.

Turf wars also developed when Amazon began allowing advertisers to bid on ads in Amazon search when a customer searched for a competitor’s product. This practice, known as “conquesting,” was not new, but battle lines formed when a big advertiser, like Roku, was advertising against searches for Amazon’s own rival products, like the Fire TV Stick. Amazon eventually blocked some of these advertisers from doing what everyone else could do with non-Amazon products.

And, of course, just the presence of an increasing number of ads on Amazon pages ruffled the feathers of some Amazon staff responsible for the overall customer shopping experience. The company’s retail division, which operates separately from the advertising division, “really believed the customer experience would be negatively impacted by ads,” a former Amazon vice president told Recode, while the ad division “figured there was a way it could be done in a smart and beneficial way.” Ads leaders would also stress how important the profits from the business were.

“We need that component of profit to continue to keep prices low,” was the basic argument, a former executive said.

And if you look at the site today, clearly the pro-ads camp has won out.

Pay to play

Amazon already has massive leverage over its marketplace sellers. Ads give it even more power. In Amazon’s most recent financial quarter, a record 58 percent of all products sold came from third-party sellers — those hundreds of thousands online merchants, mostly small and mid-sized businesses, that pay Amazon for the privilege of selling merchandise through what Amazon calls its “marketplace.”

This model has been a boon for Amazon. These sellers help ensure that the selection in Amazon’s “everything store” is unmatched by any other US retailer. Amazon also generates massive revenue from the fees it charges these sellers — to the tune of more than $28 billion, with a B, in just the last three months — for everything from just listing a product on the site, to storing and shipping items from Amazon warehouses, to customer service — and that’s not counting advertising.

Whereas five or six years ago many sellers could build a business on Amazon with a quality, differentiated product and not much more without spending any money on Amazon ads, sellers say that is just not true today.

Successful Amazon sellers have to spend anywhere between 10 percent and 20 percent of their sales on Amazon ads, according to six high-volume sellers Recode interviewed. That’s on top of the other listing and warehousing fees they also give Amazon. Some said that the pay-to-play evolution of the site is one of the top two reasons they have had to substantially raise the prices of their merchandise on Amazon over the past year. (The No. 1 reason for many, ahead of advertising costs, is increases in the fees Amazon charges sellers to store and ship their items out of its warehouses.)

One multimillion-dollar Amazon seller in the apparel category said his firm has had to double their advertising spend on Amazon over the past three years, and subsequently raised their product prices by 20 percent earlier this year.

“It’s gotta come from somewhere,” the seller, who asked to remain anonymous to speak candidly about Amazon, said.

Others, like Judah Bergman, the co-founder of a baby product brand called Jool Baby, said price increases were the only way to stay profitable.

“For some products, we realized that we need to pay for ads but we’ll never profit at our current prices,” Bergman told Recode. “We charge more and spend more on advertising, and that has worked better for us.”

For others, even with the rising ad costs, Amazon’s central position in the e-commerce landscape means spending more on Amazon ads is still better than the alternative. Shinghi Detlefsen, a former Amazon corporate employee who now runs a women’s supplement brand that does most of its sales on Amazon, said it is still more profitable to attract new customers by buying advertising on Amazon than it is by buying ads on Google or Facebook and sending those shoppers to the brand’s own site.

Graham, the Amazon spokesperson, said that advertising is a standard cost of doing business for any merchant or retailer, but that many Amazon sellers succeed without purchasing ads.

The death of organic Amazon

Either way, the Amazon shopping experience has posed hurdles for reputable Amazon sellers and customers alike since the company opened its marketplace to sellers across the world in the mid-2010s and began to aggressively promote its own branded products. A once trustworthy review system faltered as fake review schemes proliferated, with Amazon eventually making internal changes to try to drown them out, and, more recently, taking review scheme organizers to court to try to sue them out of existence. Amazon also invented new ways to promote its own branded products over those from third-party sellers, drawing the ire of regulators and lawmakers in the US and in Europe.

The sponsor-ification of the Amazon shopping experience is just the latest twist. If you’re looking closely enough, a quick search on Amazon for, say, “iPhone screen protector” or “youth soccer socks” will only turn up paid product listings carrying a “Sponsored” label at the top of the results before scrolling.

In some cases, Amazon includes a “Sponsored” label above the brand name in a smaller light-gray font. In other cases, a grouping of product listings will appear above search results, with the sponsored label relegated to the far bottom-right corner. The Federal Trade Commission has never issued guidelines specifically for search ads on a retailer’s site, but FTC staff has told general search engines in the past that since web research shows most US internet users view pages from left to right, the commission recommends that “search engines place any text label used to distinguish advertising results immediately in front of an advertising result, or in the upper-left hand corner of an ad block, including any grouping of paid specialized results, in adequately sized and colored font” — and not along the right side.

In recent years, Amazon has found new ways to toe the line on how clearly it labels its ads. In one case, it tucked a smaller, lighter “sponsored label” underneath a bigger, bolder section label of “Highly Rated.” Amazon previously had a section for organic results called “Top Rated” but launched the “Highly Rated” widget as a section for sponsored listings only. Graham, the Amazon spokesperson, said the company has since released a second type of Highly Rated section that includes both organic and sponsored results.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24183882/amazon_highly_rated_ads_screenshot.png)

Along the way, Amazon has essentially given up on effectively surfacing the best products to customers in an organic fashion, and has outsourced that key function to advertisers.

“Personally, I think turning everything into ads is not a better customer experience,” a former Amazon executive told Recode. “I think at the end of the day, consumers want to be able to trust the retailer they’re buying from … and the line has gotten so blurred now that you have no idea whether you are being surfaced something that’s actually a good product or because the seller behind it is subsidizing it.”

The Amazon spokesperson said that advertising on Amazon only works well if the company makes ads useful for customers, and that a variety of factors determine when and where ads are placed throughout the shopping experience.

Other observers made the case that shoppers would flee if they were so turned off by Amazon’s approach, and that the approach is still better than the physical retail world, where product brands are paying for shelf placement or a prominent product display at the end of the aisle, with zero disclosure to the shopper. Some sellers also told Recode that ads help draw attention to new products, and that the proliferation of advertising on Amazon may make it less profitable for nefarious merchants to do business on the site. Whereas before, they might simply be able to game Amazon’s review system to boost sales and earn prominent placement in search results, now they have to spend ad money on top of that.

Jason Goldberg, the chief commerce strategy officer at the advertising giant Publicis, said that you see a mix of both on Amazon today: Merchants and brands with great products who spend ad money to boost their sales to new heights, as well as crappy products utilizing advertising spending to boost slow-moving sales or otherwise bring more awareness to merchandise not worthy of top organic placement.

“It’s like you have retail stores with beautiful indoor displays,” paid for by a brand, Goldberg said, “and then there used to be computer stores that sold every square foot of space to the most desperate bidder. I would argue both are happening on Amazon today.”

Either way, even those who don’t love the proliferation of ads on Amazon today, or how the company chooses to disclose them, know that the ads are providing value to Amazon shoppers in at least one key way.

“They allow Amazon to maintain low prices” — at least for items Amazon stocks and sells itself — “and offer free shipping,” the former Amazon vice president said.

What’s next

Because of the role ads play, coupled with the fact that Amazon can offer advertisers data that most other ad platforms can’t, you should expect to see a lot of Amazon-placed ads in the future: both on Amazon properties and off. Amazon also benefits from changes that Apple made to user privacy on iPhones in 2021, which makes it harder for companies like Facebook to target and track ads for advertisers as iPhone users move from app to app. Since Facebook and other advertising firms can no longer follow the browsing and shopping behavior of app users without them opting in, Amazon has become an even more attractive destination for brands looking to get insights into shopping behavior and convince people to purchase their merchandise.

Amazon’s shopping site is already saturated with ads, though, so it’s unlikely that the company will substantially increase ad revenue from packing even more ad placements within its core shopping sites. Rather, more ad revenue could come from rising prices for the cost-per-click (CPC) rate that advertisers pay for sponsored ads. CPC prices typically rise if competition for ads increases among brands and sellers. And that’s exactly what these ad prices on Amazon had done, year over year, for every quarter over two years until the third quarter of 2022, according to Pacvue, an advertising software company focused on e-commerce sites. Epstein believes the CPC pullback is likely “a leading indicator of softening consumer demand,” as inflation and a weakening economy influence the way shoppers are spending money on Amazon and beyond.

So Amazon’s future ambition in advertising is targeting other parts of the web. Among them: the company’s gaming-streaming service, Twitch; live sports events like Prime Video’s Thursday Night Football; and streaming TV service Freevee. Amazon is courting a variety of marketers to those platforms, including those who want to move spending away from traditional linear TV as it gives up viewership to streaming TV services.

“Traditional TV [advertising] dollars are prime for disruption and they want to go get more of those,” said Melissa Burdick, a former Amazon senior product manager who now runs Pacvue.

Behind the scenes, Amazon has also built an advertising technology system, known as a demand-side platform (DSP), that lets brands buy ads in an automated fashion not only on Amazon properties, but all around the web. Amazon creates so-called “audiences” of internet users, based on aggregated customer browsing and purchasing behavior, or video viewing patterns, that advertisers can target with ads across the web via the DSP. Like competitors, the off-Amazon targeting component in iOS apps will similarly be hurt by Apple’s privacy changes, but the advertising agency Wunderman Thompson estimated last year that just 8 percent of the ad inventory available through Amazon’s DSP would be affected.

The company has also been investing heavily in a so-called “data clean room,” called the Amazon Marketing Cloud, that advertisers use to anonymously compare their customer base with Amazon’s to plan their Amazon ad campaigns, and to analyze how they are impacting sales.

“AMC is the best thing they’ve done since sponsored products,” said Patrick Miller, co-president of digital commerce at Ascential, which owns a portfolio of e-commerce consulting and technology companies.

Taken together, Amazon is positioning itself to become an even bigger player in the overall ad industry in the years to come. The profits the ad division generates are crucial to Amazon’s core shopping business, and the data and technology the tech giant provides to marketers are setting the company apart from most other ad firms. Both sides of this equation will argue that the end result for everyday people will be more relevant ads. But whether it actually turns out that way, or whether this advertising growth is an overall net good or bad thing for Amazon customers, merchants, and other partners, is an altogether different question. And one that doesn’t have a clear-cut answer for now.

0 Comments